Even with the pandemic restricting unnecessary travels for people, the rise of 3D virtual tours is keeping commercial real estate alive. Most buyers’ needs now have changed due to the situation, where the most in-demand office amenities used to be cafes, lounge areas, gyms, and the likes, now they are more concerned about indoor air quality, touchless technologies, outdoor amenities, and building apps.

This kind of change also prompts a change in terms of how real estate agents market properties. In this case, virtual tours have not only provided a great way to make listings stand out in such a competitive market. But it has also allowed investors and tenants to virtually tour dozens of properties before making a short-list to tour in person. This is not only convenient, cost-efficient, but more importantly safer for everyone involved.

Since this technology has given people a bit of peace of mind and another way to market commercial properties, why not focus on why one must take advantage of the current times and invest in commercial real estate.

Higher Potential Income

In commercial real estate, you’re more likely to generate higher income because of three factors: better ROI compared to residential real estate, lower vacancy risk, and leases are typically longer.

Residential real estate usually only has an average of 1% to 4% return of investment while commercial properties fetch 6% to 12%. When it comes to vacancy risk, commercial ones tend to have more available units which give investors and tenants more options so they’re more likely to be leased. Lastly, there’s less tenant turnover because leases in commercial properties are typically longer.

Consistent Stream Of Income

Speaking of longer lease periods in commercial real estate, investors also get to enjoy a much more stable cash flow. You can even multiply your source of income a lot faster because of multiple units available for lease. Moreover, since tenants are usually the ones shouldering the building’s real estate taxes, property insurance, and maintenance costs, you as the owner enjoys the consistent stream of income without having many expenses along the way.

Less Competition

There’s a perception that commercial real estate is more tricky to invest in compared to residential ones. And because of that, there’s relatively less competition in the market for you. But you should know that it doesn’t mean this area of investment is actually easier.

If you want to succeed in this commercial real estate, you still have to be proactive especially in marketing. You have to be creative, tech-savvy, meticulous in planning, and understanding when it comes to tenants’ needs. And speaking of tech-savvy, implementing a marketing technology like virtual tours can help you get ahead of the competition.

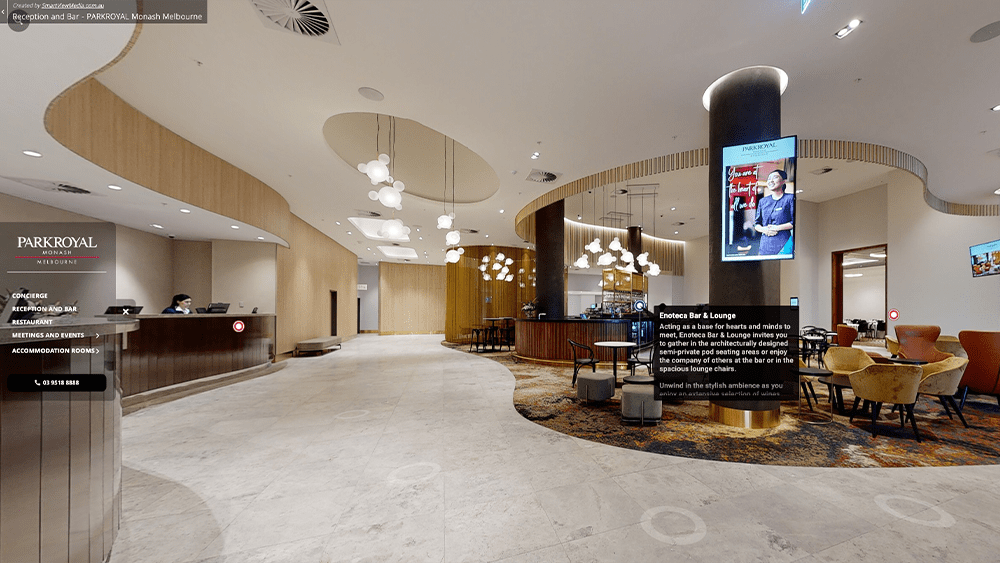

It will provide them with the best visuals of your units as Matterport is known for creating highly realistic virtual environments. It is very interactive without compromising quality. People taking a Matterport 3D virtual tour can view the space from any angle and get a 360-degree view while exploring from a first-person viewpoint. So, you can rest assured that they’ll feel like you’re actually in that property without actually going. Aside from that, you can inform and engage them immediately since virtual tours can be taken anytime and anywhere. So they won’t have to wait for weeks or months to schedule a visit like the usual in-person tour because as soon as they find your listing, they can take the virtual tour on their phones or computers.

Longer Lease Agreements

Unlike residential properties where the lease contracts are often monthly or sometimes quarterly and annually at most, commercial properties standard lease agreements are signed for multiple years. This then means guaranteed income for a longer period of time and an impressive return on investments.

Business To Business Relationships

Aside from tenants, investing in commercial real estate also leads to more business relationships with other businesses that your tenants may be connected to. This then builds your network in the field as well as other related ones which means your business has more opportunity to grow as you interact with more professionals in this line of work. All of that will be good for your income and bottom line.

Limited Operating Hours

This may not be much of a benefit but it’s nice and many people enjoy it, especially those with an active lifestyle. Since your business hours will be matched with your tenants’ then you’re most likely free outside of those times. Unlike residential properties where maintenance requests or other issues may come up any time of the day. Many commercial investors who choose to manage their own properties enjoy this benefit, as it helps allow for a sense of separation between property ownership and regular life.