There is no question that the coronavirus has slowed down a lot of businesses globally. Some have even closed. But the commercial real estate has been slowly getting back on track recently.

While that has a lot to do with investors taking advantage of the good side of the situation and are applying the age-old buy low/sell high practice. Real estate agents are also playing smart and using technology to its fullest right now.

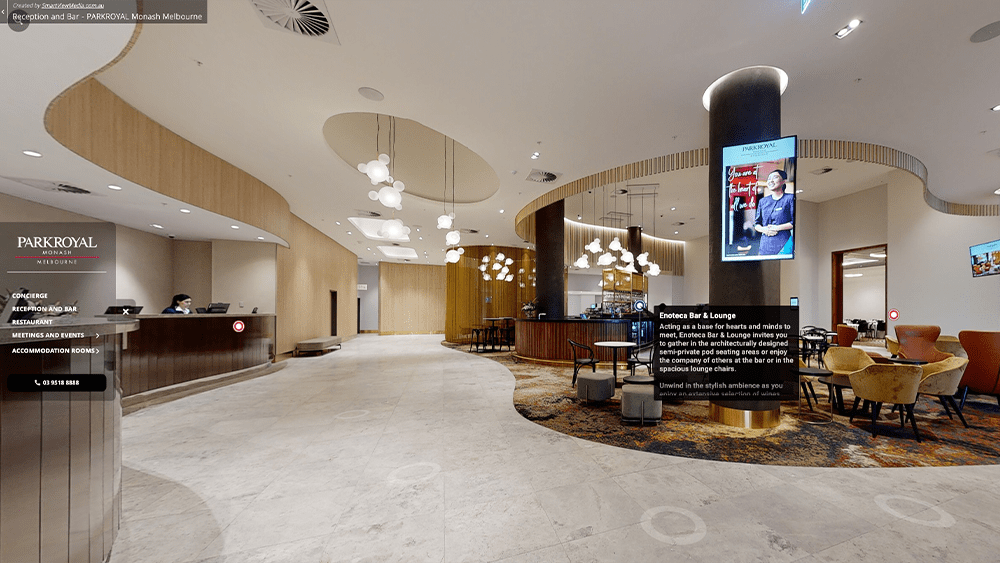

Aside from the fact that the majority of transactions and meetings are taking place online right now, they’ve also used this opportunity to upgrade their marketing techniques using virtual tours. It is the digital age, after all, they cannot expect to do well without taking advantage of that. Aside from the standard photos and videos to promote listings, implementing Matterport 3D virtual tours in their marketing is becoming popular and a must.

Virtual tours, along with panoramic and 360° view, allows the viewer to easily find his way around the property with the ability to quickly navigate specific rooms and zoom in on its features. Aside from that, it also includes a floor plan and measurements to give a clear perspective of how large or small a room or space is relative to another and provides the actual size of the room, alley, or any physical feature. Offering this is convenient not only for prospective buyers but as well as the agents because it not only helps make a part of their job easier but it also promotes listings really well. They also include virtual tours in their website as well as social media platforms for increased online visibility which of course boosts the company and sales at the same time.

This is, in part, why investors have started to feel confident in the commercial real estate market again. In fact, the annual Investment Intentions Survey – undertaken by the Asian Association for Investors for Non-Listed Real Estate Vehicles (ANREV), the European Association for Investors in Non-listed Real Estate Vehicles (INREV), and the Pension Real Estate Association (PREA) in the US – showed little change in investment decisions compared to 2019.

Core properties remained the most favored property type among investors, even with the challenges of the pandemic still ongoing this 2021. And then followed by industrial/logistics, residential, and retail. Included in the survey are the top 8 destinations that investors around the world seem to be drawn to.

Sydney

According to the survey, Sydney is now the number one choice for institutional investors in 2021. It showed that office properties are the most favoured type of investment in this city according to the 84% of respondents in the survey, with 100% of US investors saying they plan to invest in these cities. And even with the 10% drop in office rents, rising incentives to occupiers, and vacancy rates continuing to rise in the city, investors are still going for it.

Melbourne

Due to the Victorian government’s decision to create high-level, Growth Corridor Plans, Melbourne’s north, west, and south-east has rapidly grown. This urban planning includes integrated land use and transport schemes that provide a strategy for the development of Melbourne’s growth corridors over the coming decades. This then provided opportunities for savvy investors as well because they are foreseeing that this expansion will add further value to the city.

Tokyo

With the rise of Japan’s economy, the price of properties in Tokyo has been on the rise as well. Investors are now targeting Shinjuku ward because it is said to offer the best returns. It is expected to get a 4.75 % average return if one invests in a 10-year-old property. And the older the building gets, the better the returns are expected to be. On average, 30-year-old properties yield 5.3% returns while you get 4.3% on brand-new to 5-year-old units.

Osaka

“Osaka is one of Japan’s most important cities, but what we’re seeing is an effort to extend its reach internationally,” says Jeremy Kelly, head of JLL Cities Research. “With its rapidly growing visitor economy, as well as high profile events like the G20 and Expo 2025, Osaka is currently experiencing the first cycle of globalization by building its international reputation.”

Even in the past years, Osaka has always been a popular tourist destination. According to the Osaka Convention and Tourism Bureau, a total of 11.42 million foreign visitors have been to the city in 2019 alone which is a record high for five years running. Hotels and restaurant constructions rose six-fold during the same period because of developers trying to get the most out of this growth. It was also announced that Kansai Airport has invested $ 911 million to upgrade its facilities and boost capacity in order to attract even more travellers across the globe.

Seoul

Due to the surprise decision of The New York Times to move part of its digital operations in Seoul from Hongkong, South Korea’s capital became even more confident to be the country’s leading financial centre. That and along with the growing global recognition that it is currently experiencing due to its cultural exports like the K-pop band BTS and the breakthrough film Parasite. So it’s no surprise that global investors would also start investing in Seoul.

Other Japanese Cities

Japan is recognized as the second-largest market in Asia because of its retail market that is as complex as China mainly due to its diverse culture and consumer behaviour. And since global retailers place a high value on setting up their Asia’s grandest flagships on the most expensive streets and hottest spots in Japan, the country continues to be a preferred destination for investors.

The 2020 Summer Olympics may have driven drawn more investors to Japan as a flagship destination, the $1.35 trillion retail sales in 2019 still prove that it has been recognized as a global key country long before that. Compared to other Asian markets, Japanese’ buying habits and merchandise are a lot more unique because of their culture and its society in general. Although, retailers are compelled to continuously reinvent themselves and their stores in order to gain a competitive edge because of Japan’s unparalleled high service standards.

Singapore

Singapore was crowned the best nation to invest in or do business in for 2020 because it offers “more stable investments with less volatile income returns” and high-quality assets for investors, said Terence Tang, a managing director at Colliers.

And one of the best reasons why investors flock to Singapore is that it has a strong real estate industry. The country attracts many expats from across the world which breeds demand for real estate which is why it has such a thriving and booming real estate industry and is considered one of the leading real estate hubs in Asia.

Other Australian Cities

Interestingly, Australia’s commercial property became even more popular with overseas investors looking at the Asia Pacific. The continent performed well across all sectors including education and research, market potential, and trade openness. Cities in Australia are considered an ideal destination to deploy capital because even during these uncertain times, they still offer stable investments with less volatile income returns.